All businesses are subject to an ordinary rate, however, some are also liable for special rates.

Council has the following special rates:

- CBD Promotional Levy

- CBD Parking

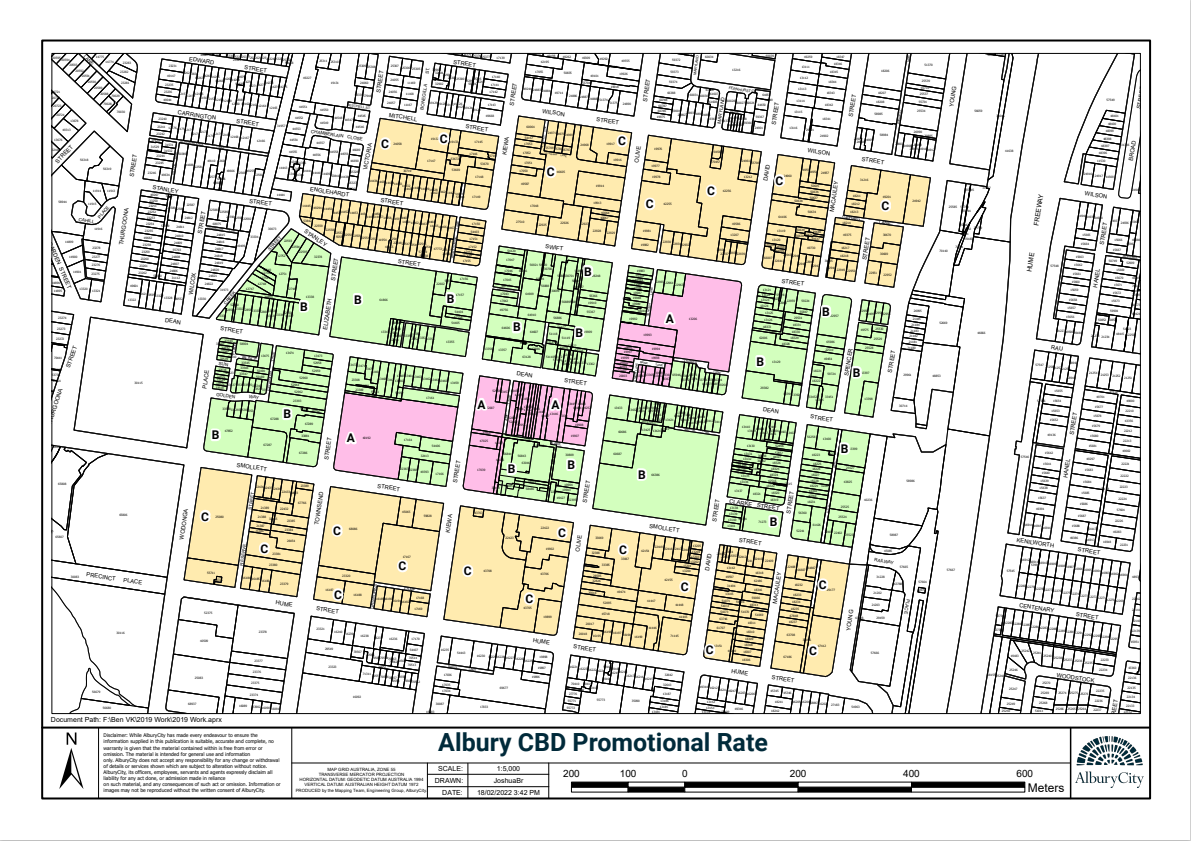

Promotional levy zones

The Promotional Levy Zones special rate is not applicable to all land but is concentrated on business categorised properties in a specific area of the Albury CBD.

This special rate raises revenue that is collected and forwarded to the organisation known as AlburyCBD and applied to programs to promote the Albury CBD.

To calculate the Promotional Levy zones rates, Council uses the following method:

(individual unimproved land value x ad valorem rate) = Promotional Levy Zone special rate charge ($)Promotional Levy Zone Map

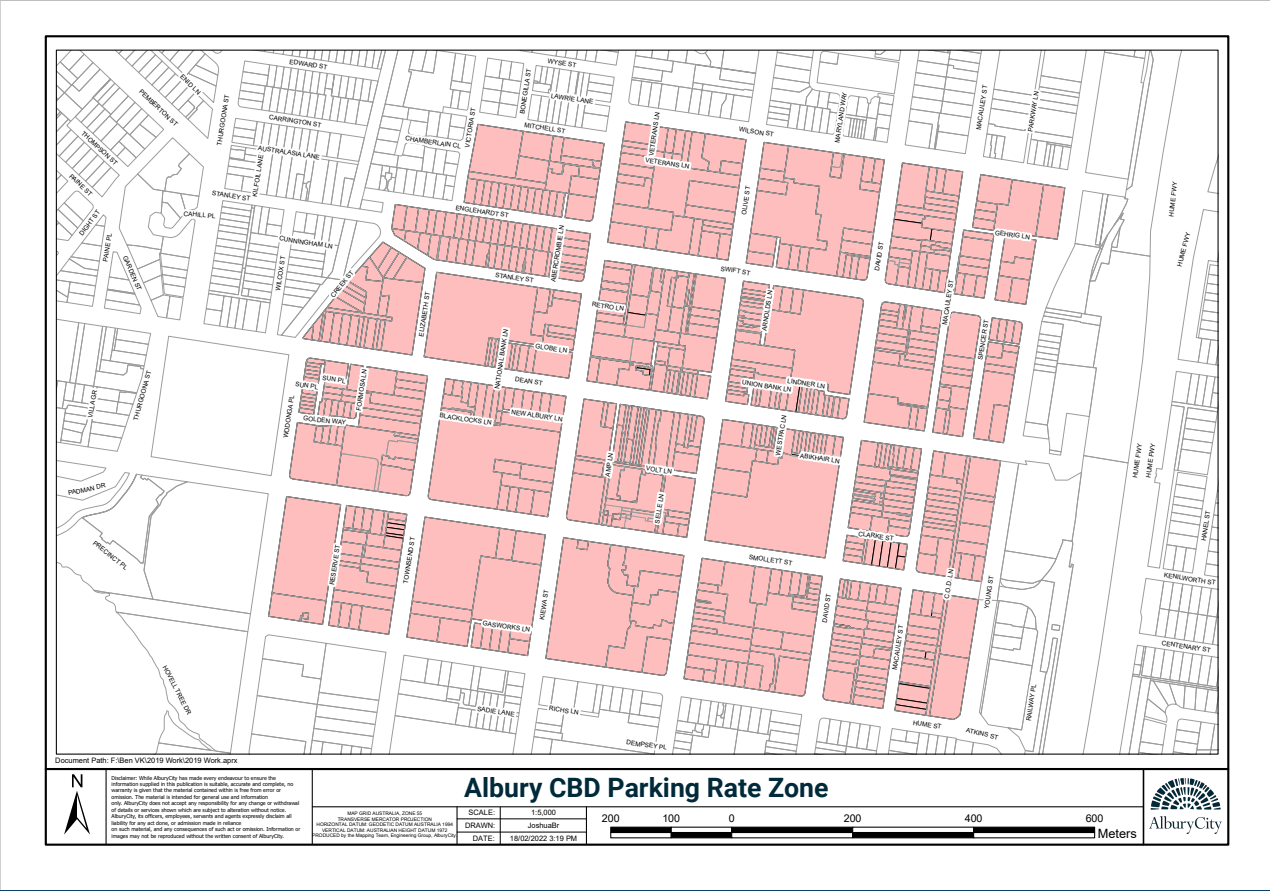

Albury CBD Parking Levy

The Albury CBD Parking special rate is not applicable to all land but is concentrated on business categorised properties in a specific area of the Albury CBD. This special rate raises revenues that are applied to maintain existing car parking areas in Albury CBD.

To calculate the Albury CBD Parking levy, Council uses the following method:

(individual unimproved land value x ad valorem rate) = CBD parking Levy rate charge ($)CBD Parking levy Map